8 Key Steps of the Medical Billing Process

8 Key Steps of the Medical Billing Process

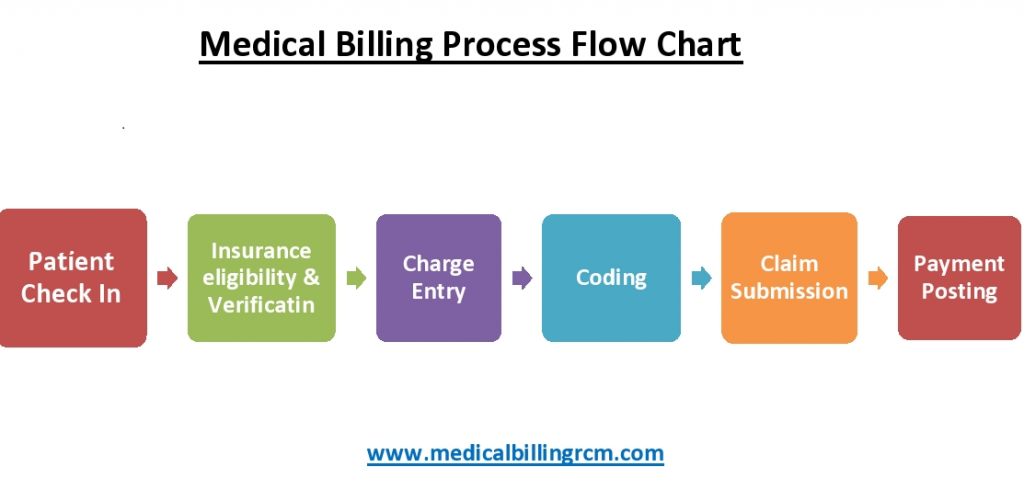

The Medical Billing Process.

Medical billing is a large and complicated subject. However, the medical billing process involves of few simple steps.

In the medical billing process, the medical care provider properly documents, submits and follow-ups on medical claims with the medical care insurance companies to take payment for the services given to the patients.

The medical billing process includes registration of patients, verifying financial responsibility, check-in and check-out of patients, preparing and transmitting claims, monitoring payer adjudication, prepare patient statements and follow up on patient payments and settlement.

The medical billing process consists of a sequence of steps done by medical billing specialists. Relying upon the circumstances, it will take a matter of days to finish, or could stretch over many weeks or months.

Even though the medical billing process in the past used to be done using paper-based strategies and handwritten or typewriter-drafted documents, the emergence of multiple technologies within the medical care industry has transitioned it to an electronic method. This has resulted in savings of time and money and minimized human and administrative errors.

Remember that medical billing has “front-of-house” and “back-of-house” responsibilities. We’ll see an in-detail description regarding every step in the medical billing process.

1. Register Patients – Very 1st step of the medical billing process

Patient registration is the opening one in the medical billing process. Once a patient calls to line up an appointment with a medical care provider, they or register for his or her doctor’s visit.

This has basic demographic details on a patient, together with name, birth date, and also the reason for a visit. Additionally, Insurance-related details were collected, which include the name of the insurance supplier, Insurance plan, and also the patient’s policy number, and verified by medical billers. These details are used to line up a patient file that may be referred throughout the medical billing process.

If the patient has seen the provider before, their detail is on file with the provider, and the patient only has to describe the case for their visit. If the patient is for their first visit, they should give personal and insurance details to the provider to confirm that they are granted to have services from the provider.

The demographic details and insurance details should be carefully noted and must update if the patient frequently visits the medical practice because it forms the idea of a medical claim for which the healthcare providers will be remunerated.

Now, most practices use advanced medical billing and coding software wherever patient details are entered just once, and patients don’t have to go through the difficulty of giving details when they go to the hospital or clinic every time.

This step entails establishing financial responsibility for a patient visit and includes functions like check-in and insurance eligibility and verification of the medical billing process.

2. Verifying financial responsibility

Financial accountability specifies who is responsible for paying what for a specific doctor’s appointment. The biller can then identify whether the patient’s insurance plan covers services once they get the necessary information from the patient.

Patients should verify their insurance details and allowance in each appointment and also the visit to medical practice as an insurance plan. The medical care provider must ask and double-check because it can directly affect the claim process and resulting compensation.

The status of insurance is checked, and only active insurance plans would be processed. Certain insurance plans wouldn’t cover certain services or prescription medications. If some procedures or services may not be coated, the patient is made aware that they will be financially responsible for those costs.

Any changes within the insurance plan or policy impact the patient’s authorization details and benefit.

3. Check-in and Check-out of patients

Patient check-in and check-out are comparatively straightforward procedures. If the patient arrives the first time, they (the provider) will be asked to fill up some forms otherwise have to confirm the details the doctor has on file. The patient will also be needed to give some official identification, like a driver’s license or passport, and a valid insurance card.

The provider’s workplace will also collect copayments when patients check in or check out. Copayments are continuously collected for the service, but the provider can determine if the patient pays the copay before or after their visit.

After the patient check-out, the medical report of the patient is received by the medical coder. He abstracts and translates the detail in the report into correct, useable medical code. This report is called the “superbill.”, which additionally have demographic detail on the patient and details about the patient’s medical history.

All of the relevant details about the medical services rendered are included on the superbill. The superbill contains the name of the service provider, the doctor, the patient, the procedures carried out, the codes for the diagnosis and strategy, and any other relevant medical data. The creation of the claim requires the use of this information.

Once finished, the superbill is sent to the medical biller, usually through software.

4. Prepare Claims and verify compliance

The medical biller receives the superbill from the medical coder and enters it into the appropriate practice management or billing software or onto a paper claim form. Billers will also include the price of the procedures in the claim. The amount they anticipate the payer to pay, as specified in the payer’s contract with the patient and the provider, will be sent to the payer instead of the total cost.

After the completion, the medical biller is responsible for the standards and format of the medical claim. However, the biller does review the codes to confirm that the procedures coded are billable. Whether or not a procedure is billable depends on the patient’s insurance plan and the laws set out by the payer.

While claims may have different formats, they typically contain essential details. Each claim includes information on the patient, including their demographics and medical history, as well as the procedures carried out (in CPT or HCPCS codes). A diagnosis code (an ICD number) that confirms the medical necessity is connected with these operations. Additionally, the cost of various functions is provided. A National Provider Index (NPI) number is used in claims to identify the provider.

The value for these procedures is listed as well. Claims additionally have details about the provider, listed via a National Provider Index (NPI) number. Some claims also include a Place of Service code, that details what style of facility the medical services were performed in.

Billers must also ensure that the bill complies with all applicable billing regulations. Typically, billers must adhere to rules set forth by the Office of the Inspector General (OIG) and the Health Insurance Portability and Accountability Act (HIPAA) (OIG). Due to space and efficiency concerns, we won’t go into great detail on OIG compliance criteria. However, they are straightforward but extensive.

5. Claims transmission

After the claim has been checked for accuracy and compliance, submission is the next step of the medical billing process.

The claim is ready when the patient information, health provider information, and service provided are added to the claim form and will be submitted to the insurance company for compensation.

All health entities covered by the Health Insurance Portability and Accountability Act of 1996 (HIPAA) must file their claims electronically, with few exceptions. HIPAA protects the majority of payers, clearinghouses, and providers.

At present, because of the new technology, the claims are submitted electronically through a system named ‘Electronic Data Transfer (EDI).’

Billers may still use manual claims; however, this practice has many drawbacks. Manual claims have a lot of errors, minimum efficiency, and take much time to get from providers to payers. Can save time, effort, and money, and significantly minimize administrative error in the medical billing process by doing this process electronically.

Large quantity third-party payers, like Medicare or Medicaid, medical billers can submit the claim straightly to the payer. However, a biller possibly bears a clearinghouse without submitting a claim directly to large payers.

A clearinghouse accepts and rearranges claims from medical billers and transmits them to payers. Claims have to be submitted very clearly for payers.

A clearinghouse is a third-party corporation or organization that accepts bills’ claims, reformats them, and then sends them to payers. Some payers have exact formats that claims must be submitted in. Clearinghouses lessen the burden on medical billers by gathering the data required to make a claim and then putting it in the proper form.

Consider it like this: A practice might submit ten claims to ten separate insurance companies, each with its own rules for filing claims. A biller can send the pertinent data to a clearinghouse, who will then be responsible for reformatting those ten separate claims rather than format each claim individually.

6. Monitor claim adjudication

After the claim reaches a payer, adjudication is the next medical billing process. In adjudication, a payer prepares a medical claim, checks the validity of the claim and if the claim is valid, the amount of money of the claim the payer will repay to the provider. In this stage, a claim can be accepted, denied, or rejected.

An accepted claim has been initiated valid by the payer. Accepted doesn’t essentially mean that the payer pays the full of bill. Preferably, they process the claim within the rules of the agreement they have with the patient. An accepted claim is paid according to the insurer’s agreements with the provider.

A rejected claim has some errors. If a claim is missing or miscoded important patient details, the claim will be rejected and will be returned to the biller. Then, the biller has to correct the claim and resubmit it.

A denied claim is one that the payer rejects to do payment for the medical services supplied. This can happen when a provider bills for a procedure that is not included in a patient’s insurance coverage. This might have a procedure for a pre-existing condition (if the insurance plan does not cover such a procedure).

The payer will send a report to the provider, specifying how much of the claim they are ready to pay and the reason, after the payer adjudication is completed. This report notes down the covered procedures and the amount assigned for each procedure by the payer.

This type differs from the fees listed in the initial claim. The payer normally incorporates a contract with the provider that set down the fees and compensation rates for a variety of procedures. The report will describe the reasons for some processes that won’t be covered by the payer.

The biller confirms all procedures listed on the early claim are accounted for in the report by reviewing this report. And also check the payer’s report to match those of the initial claim. Finally, the biller will check to make sure the fees in the report are accurate concerning the contract between the payer and the provider.

If there are any mismatches, the biller/provider will enter into an appeal process with the payer. Worthwhile, appeal a claim is a process by which a provider tries to secure the correct compensation for their services.

This procedure is intricate and is governed by laws unique to payers and the states where providers are based. In reality, a claims appeal is the procedure a provider uses to get paid fairly for their services. Billers must make correct, “clean” claims because this procedure can be time-consuming and difficult.

7. Prepare patient statements

Creating a statement for patients who have an outstanding balance with the practice is the responsibility of a medical biller. After the claim has been processed, the patient is billed for any outstanding charges.

This statement includes a detailed list of the procedures and services provided, their costs, the amount paid by insurance, and the amount due from the patient.

In some cases, a medical biller includes an Explanation of Benefits (EOB) with the statement. An EOB provides details about benefits, and what kind of coverage a patient receives under their plan. EOBs can be important in describing to patients why some procedures were covered and why others were not.

The medical biller usually initiates a set of processes, If a patient doesn’t pay his or her bill within the correct time period.

Once all the checks are done, and also the insurance company decides to pay the claim, then either a paper check or electronic fund transfer is created.

8. Follow up on patient payments and settlement

The final and most important part of the medical billing process is guaranteeing those bills get, well, paid. Medical Billers are in charge of mailing out billings timely, correcting medical bills, and following up with difficult patients’ bills. After the bill is paid, that detail is stored in the patient’s file.

It’s the responsibility of the biller to confirm that the provider is properly reimbursed for their services when the patient is irresponsible in their payment or if they don’t pay the full payment. This may involve contacting the patient directly, sending follow-up bills, and if it isn’t working would hire a collection agency.

Every provider has its terms of bill payment, notifications, and collections. Medical billers refer to the provider’s terms before taking part in activities.

Hospitals and medical care facilities no longer have to chase insurance agencies for settlement of payments.

Leave a Comment